Generalised Additive Models - mgcv (WIP)

A replication of the ecological models per Hierarchical generalized additive models in ecology: an introduction with mgcv using stock data.

Packages and data

Load the required packages and the standard data set for analysis

library(romerb)

library(mgcv)

library(gratia)

data("stock_data")

fundamental_raw <- stock_data

rm(stock_data)

# Data

df <- fundamental_raw[fundamental_raw$date_stamp == as.Date('2021-06-30'), ]

df$log_mkt_cap <- log(df$mkt_cap)

df$log_book <- log(-df$total_equity_cln)

df$roe <- df$roe * -1

df <- df[df$date_stamp == as.Date('2021-06-30'), c('symbol','sector','log_book','log_mkt_cap','log_pb','roe','leverage')]Hierachical GAM (model type GS)

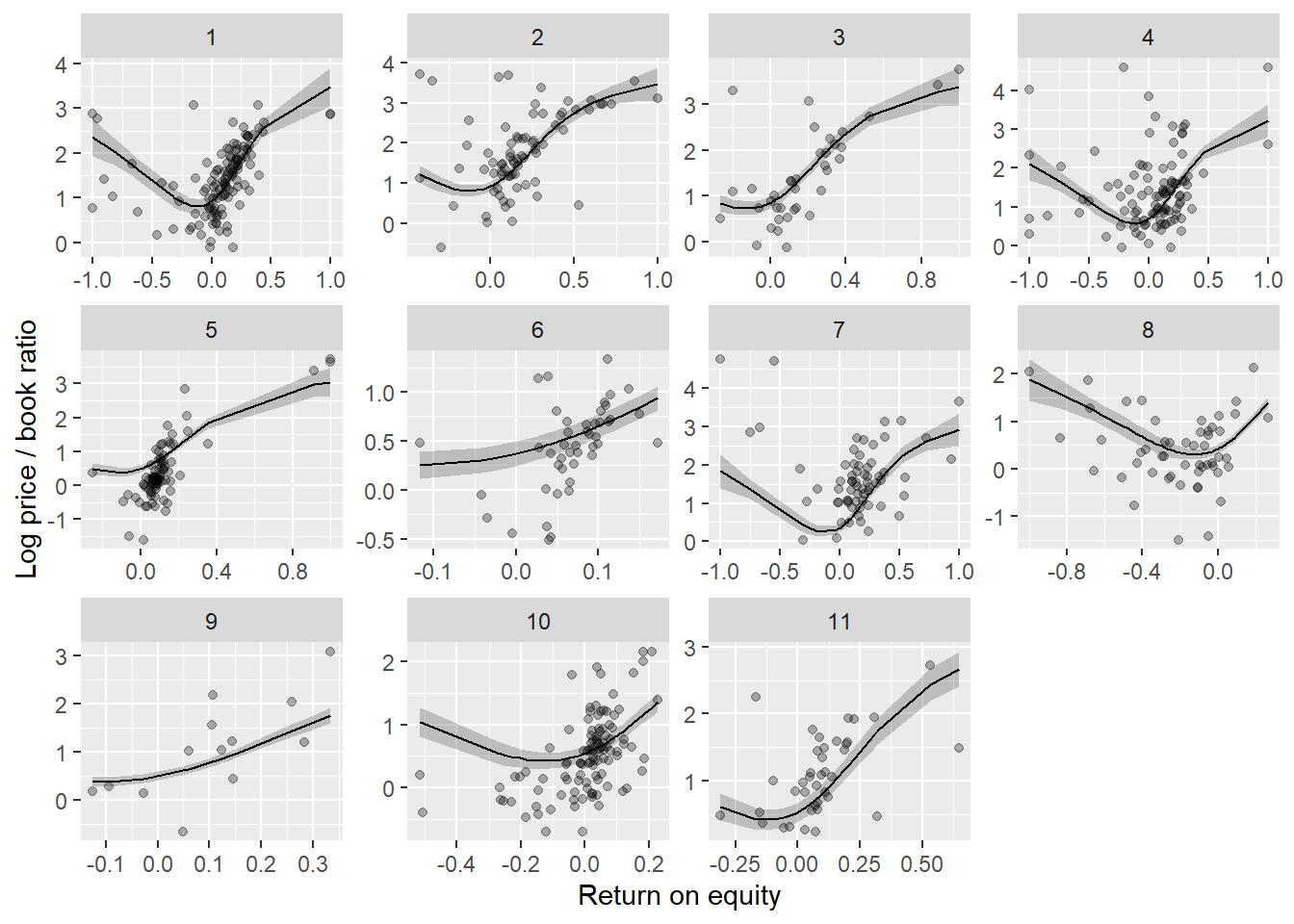

Using the factor smooth basis.

# Model

gam_mlm1 <- gam(

log_pb ~ s(roe, k = 5, m = 2) + s(roe, sector, k = 5, m = 2, bs = "fs"),

data = df,

method = "REML"

)

# Predict

gam_mlm1_pred <- predict(gam_mlm1, se.fit = TRUE)

df$pred <- gam_mlm1_pred$fit

df$sepred <- gam_mlm1_pred$se.fit

# Visualise

ggplot(data = df, aes(x = roe, y = log_pb, group = sector)) +

facet_wrap(~reorder(sector, as.numeric(sector)), ncol = 4, scales = 'free') +

geom_ribbon(aes(ymin = pred - 2 * sepred,

ymax = pred + 2 * sepred), alpha=0.25) +

geom_line(aes(y = pred)) +

geom_point(alpha = 0.3) +

labs(x = 'Return on equity',

y = 'Log price / book ratio')

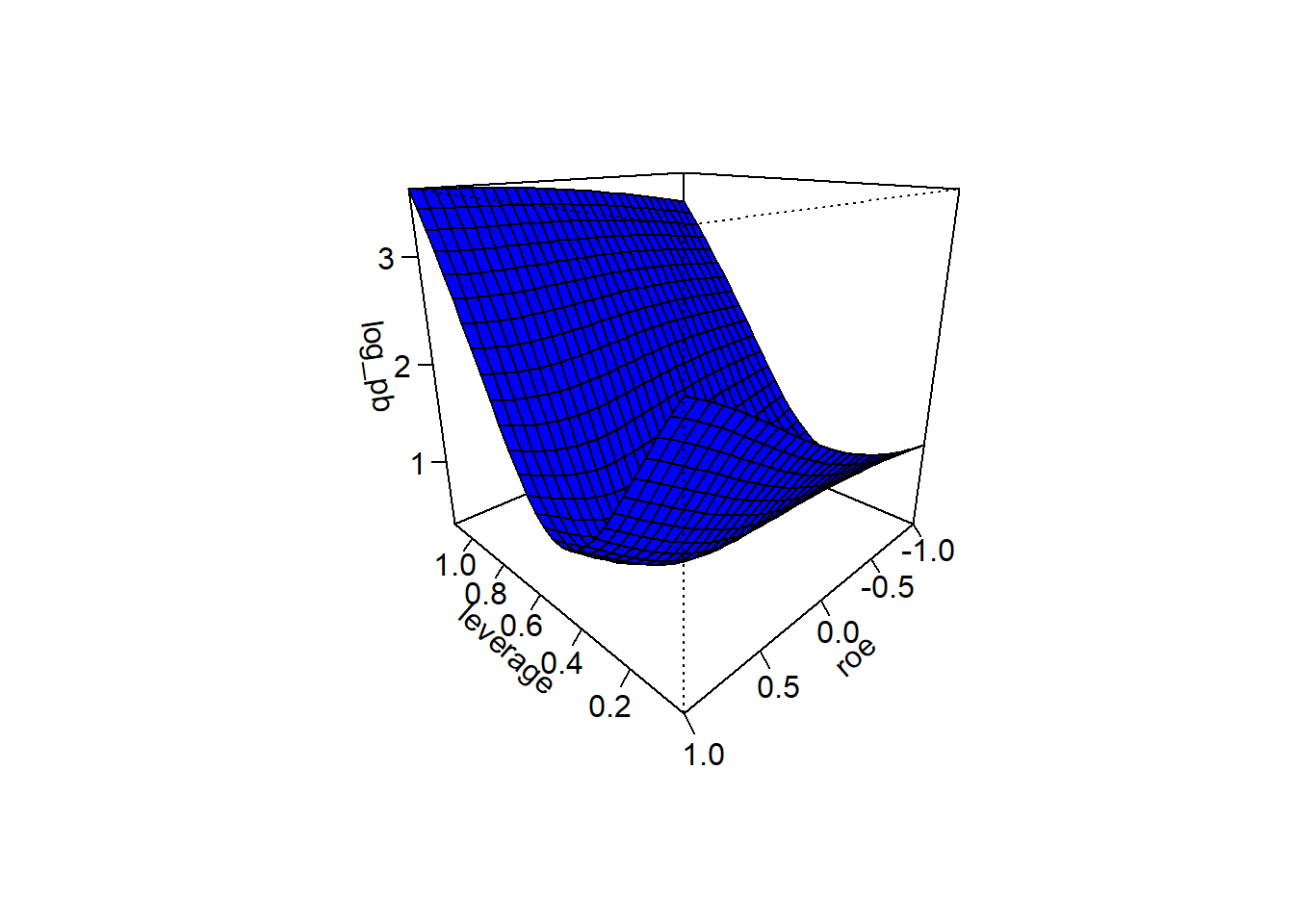

Non-hierachical & 3d visualisation

# Model

gam_mlm2 <- gam(

log_pb ~ s(roe, leverage, bs = "tp", k = 5, m = 2), #+ s(roe, sector, k = 5, m = 2, bs = "fs"),

data = df,

method = "REML"

)

# Predict

interval <- 30

roe <- with(df, seq(min(roe), max(roe), length = interval))

leverage <- with(df, seq(min(leverage), max(leverage), length = interval))

new_data <- expand.grid(roe = roe, leverage = leverage)

gam_mlm2_pred <- matrix(predict(gam_mlm2, new_data), interval, interval) #, type = "response"

# Visualise

# https://bikeactuary.com/datasci/gams_scams_pt1

persp(

x = leverage,

y = roe,

zlab = 'log_pb',

gam_mlm2_pred, theta = 225, phi = 20, col = "blue", ticktype = "detailed")

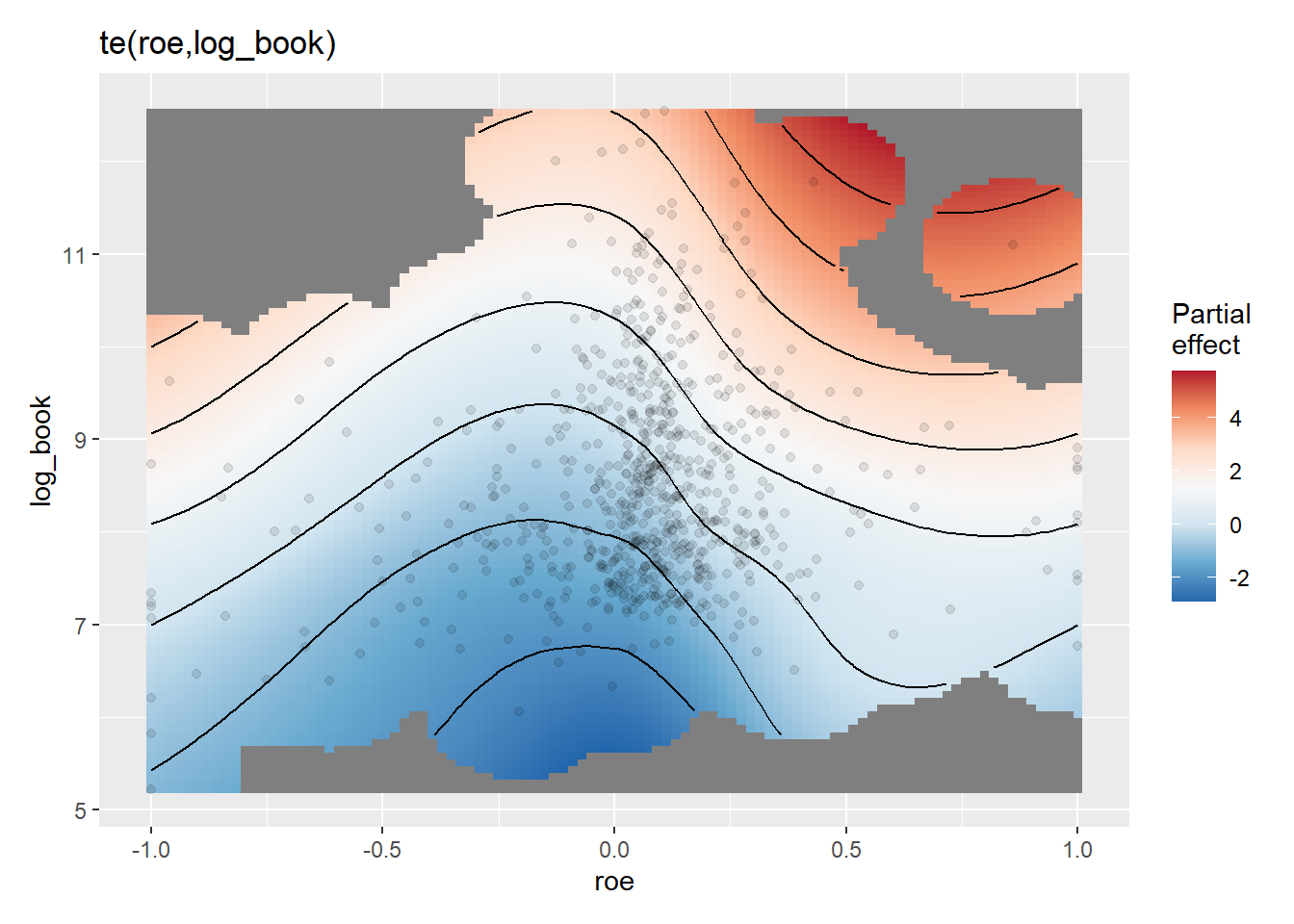

Single level interaction model

Using a tensor product smooth. Modelling market capitalisation on return on equity and book value of equity.

# Model

gam_te1 <- gam(

log_mkt_cap ~ te(roe, log_book, bs=c("cc", "tp"), k=c(10, 10)),

data = df, method = "REML"

)

# Visualise

gratia::draw(gam_te1)

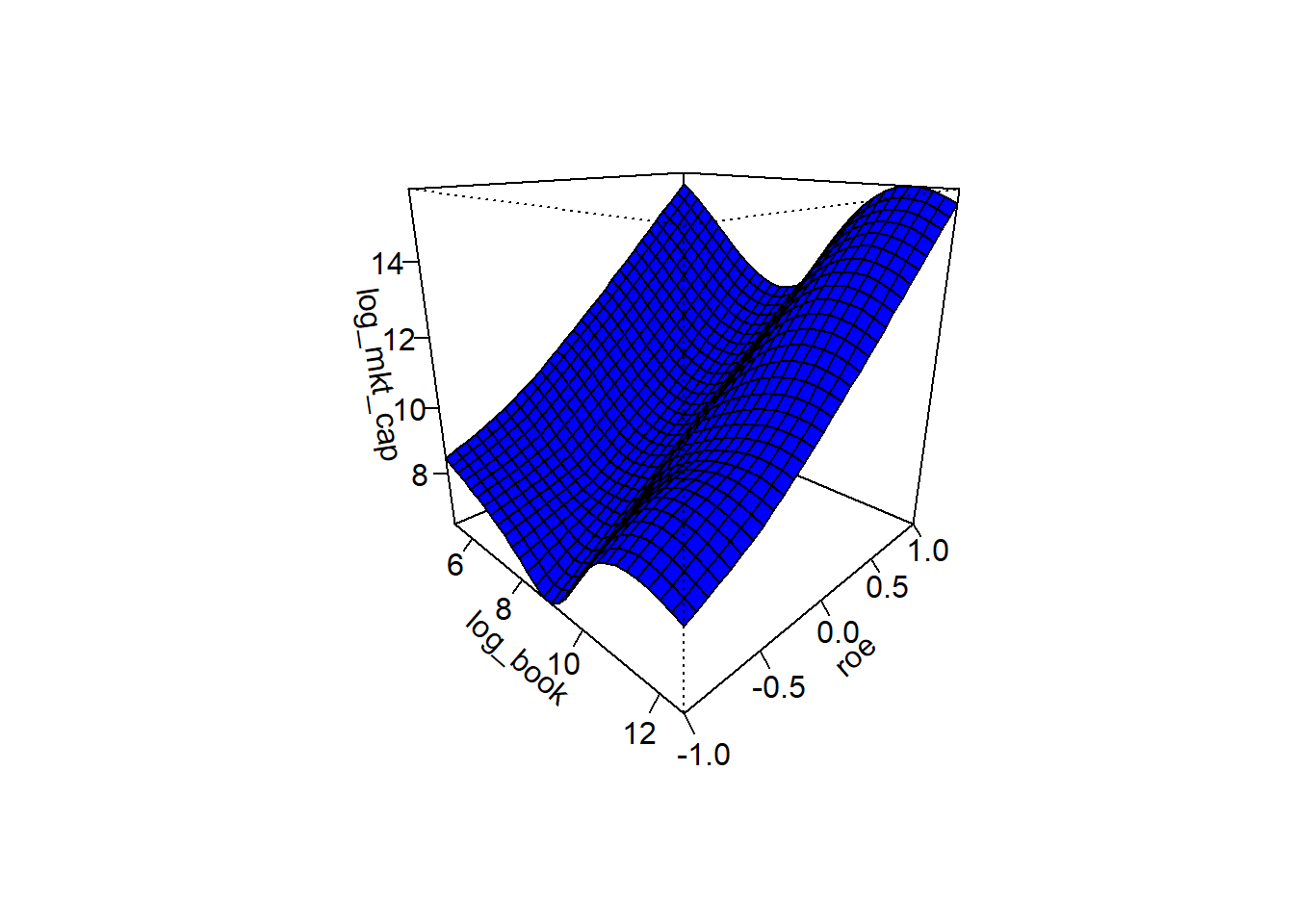

Same model, visualise with a 3d plot.

# Predict

interval <- 30

roe <- with(df, seq(min(roe), max(roe), length = interval))

log_book <- with(df, seq(min(log_book), max(log_book), length = interval))

new_data <- expand.grid(roe = roe, log_book = log_book)

gam_te1_pred <- matrix(predict(gam_te1, new_data), interval, interval)

# Visualise

persp(

x = log_book,

y = roe,

zlab = 'log_mkt_cap',

gam_te1_pred, theta = 45, phi = 20, col = "blue", ticktype = "detailed")

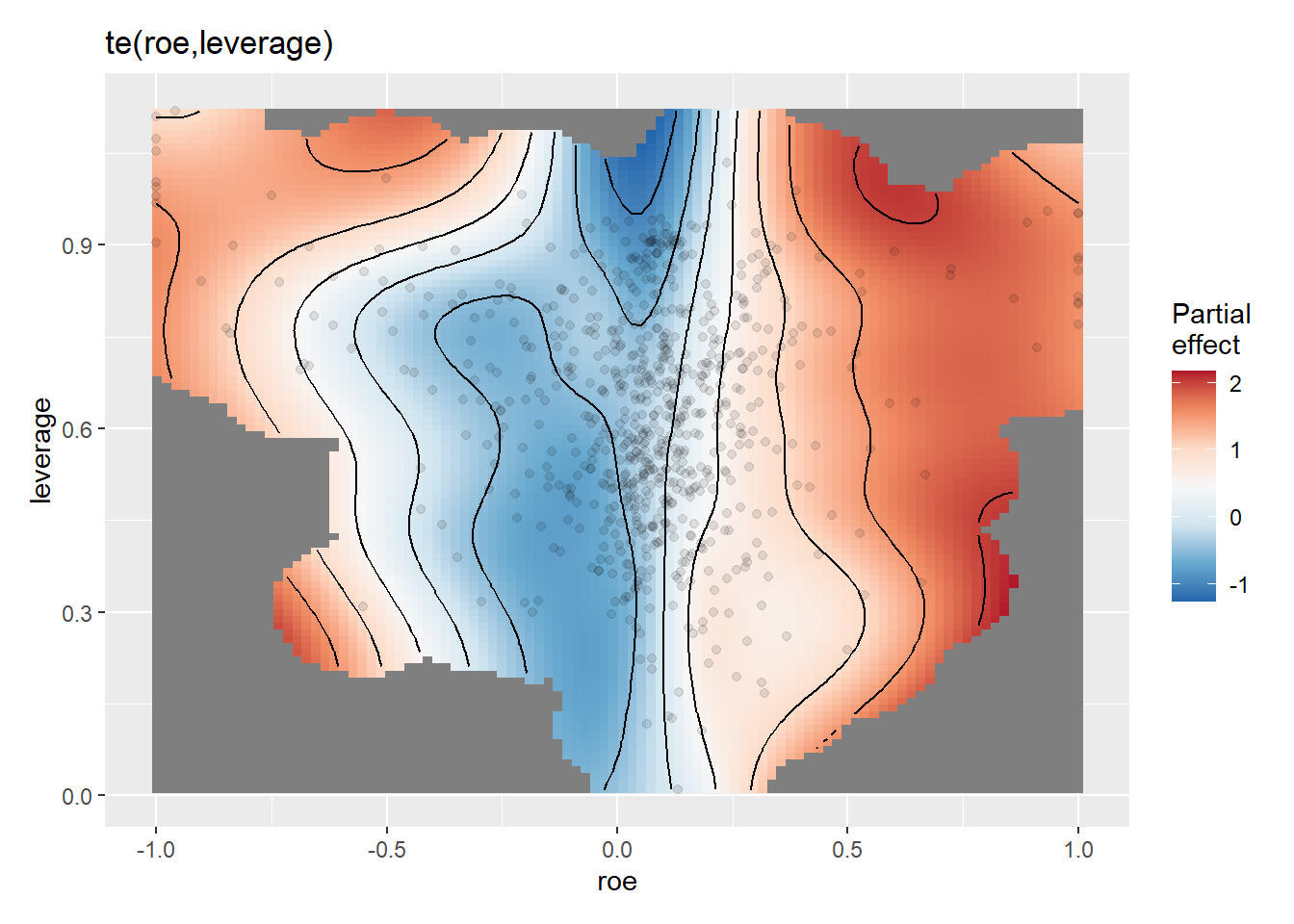

Modelling price to book ratio on return on equity and leverage.

gam_te2 <- gam(

log_pb ~ te(roe, leverage, bs=c("cc", "tp"), k=c(10, 10)),

data = df, method = "REML"

)

gratia::draw(gam_te2)

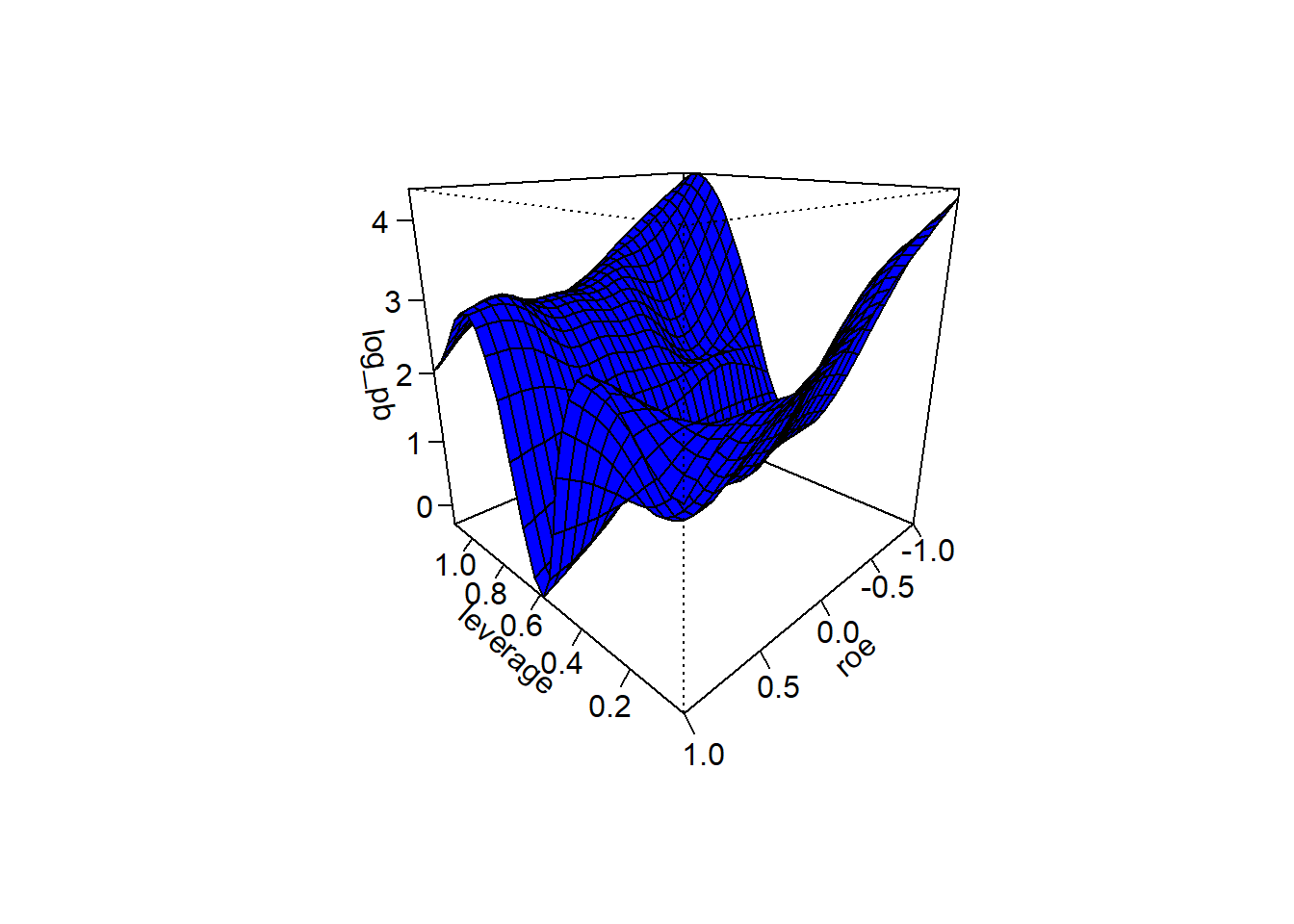

Same model, visualise with a 3d plot.

# Predict

interval <- 30

roe <- with(df, seq(min(roe), max(roe), length = interval))

leverage <- with(df, seq(min(leverage), max(leverage), length = interval))

new_data <- expand.grid(roe = roe, leverage = leverage)

gam_te2_pred <- matrix(predict(gam_te2, new_data), interval, interval)

# Visualise

persp(

x = leverage,

y = roe,

zlab = 'log_pb',

gam_te2_pred, theta = 225, phi = 20, col = "blue", ticktype = "detailed")

Once again using plotly.

References

3d plots with color

https://stackoverflow.com/questions/22652941/how-to-add-colorbar-with-perspective-plot-in-r https://stackoverflow.com/questions/31374951/add-points-and-colored-surface-to-locfit-perspective-plot https://stackoverflow.com/questions/24918604/how-to-have-only-every-other-border-in-a-persp https://stackoverflow.com/questions/3786189/r-4d-plot-x-y-z-colours