Gaussian Process regression - base R

A replication of the Gaussian Process regression implementation from chapter 5 of Surrogates. Application of the same code to real data.

Chapter example

Data

Create some dummy data being an independent and dependent variable, along with a grid of the independent variable values.

# Training data

n <- 8

X <- matrix(seq(0, 2*pi, length=n), ncol=1) # independent variable

y <- sin(X) # dependent variable

# Predictive grid

XX <- matrix(seq(-0.5, 2*pi + 0.5, length=100), ncol=1)Covariance function / kernel

Using inverse exponentiated squared distance.

Note that the first three lines below can be replicated with

D <- plgp::distance(X).

D <- dist(X, diag = T, upper = T)

D <- D**2

D <- as.matrix(D) # euclidean distance

eps <- sqrt(.Machine$double.eps) # nugget / jitter

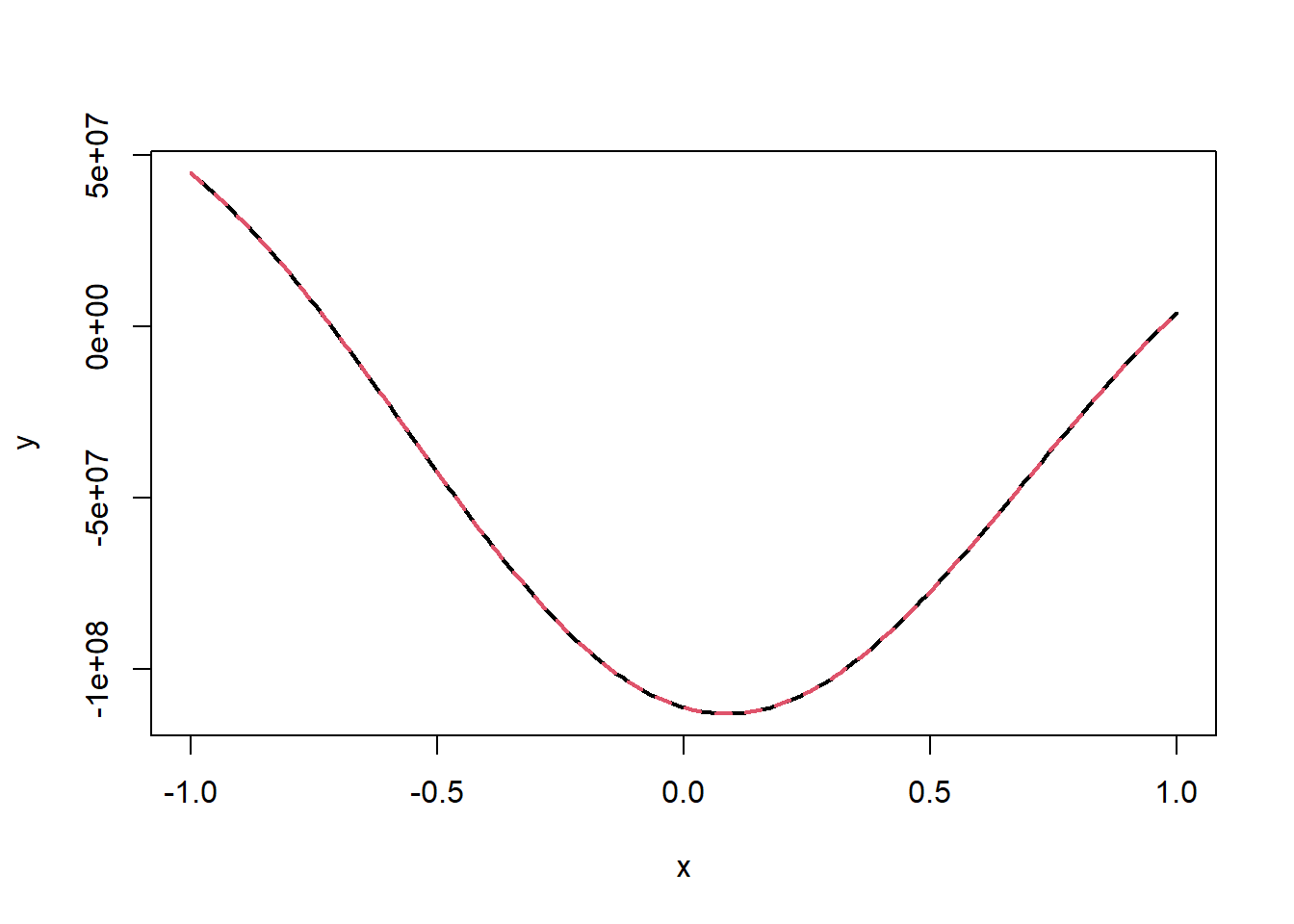

Sigma <- exp(-D) + diag(eps, ncol(D)) # exponentiated squared euclidean distanceMulti-variate normal conditioning

Covariance of testing grid data points.

DXX <- as.matrix(dist(XX, diag = T, upper = T)**2) # Is this the same as plgp::dist?

SXX <- exp(-DXX) + diag(eps, ncol(DXX))Covariance between testing grid and training data.

Kriging equations, mean mup and variance

Sigmap.

Posterior/predictive distribution

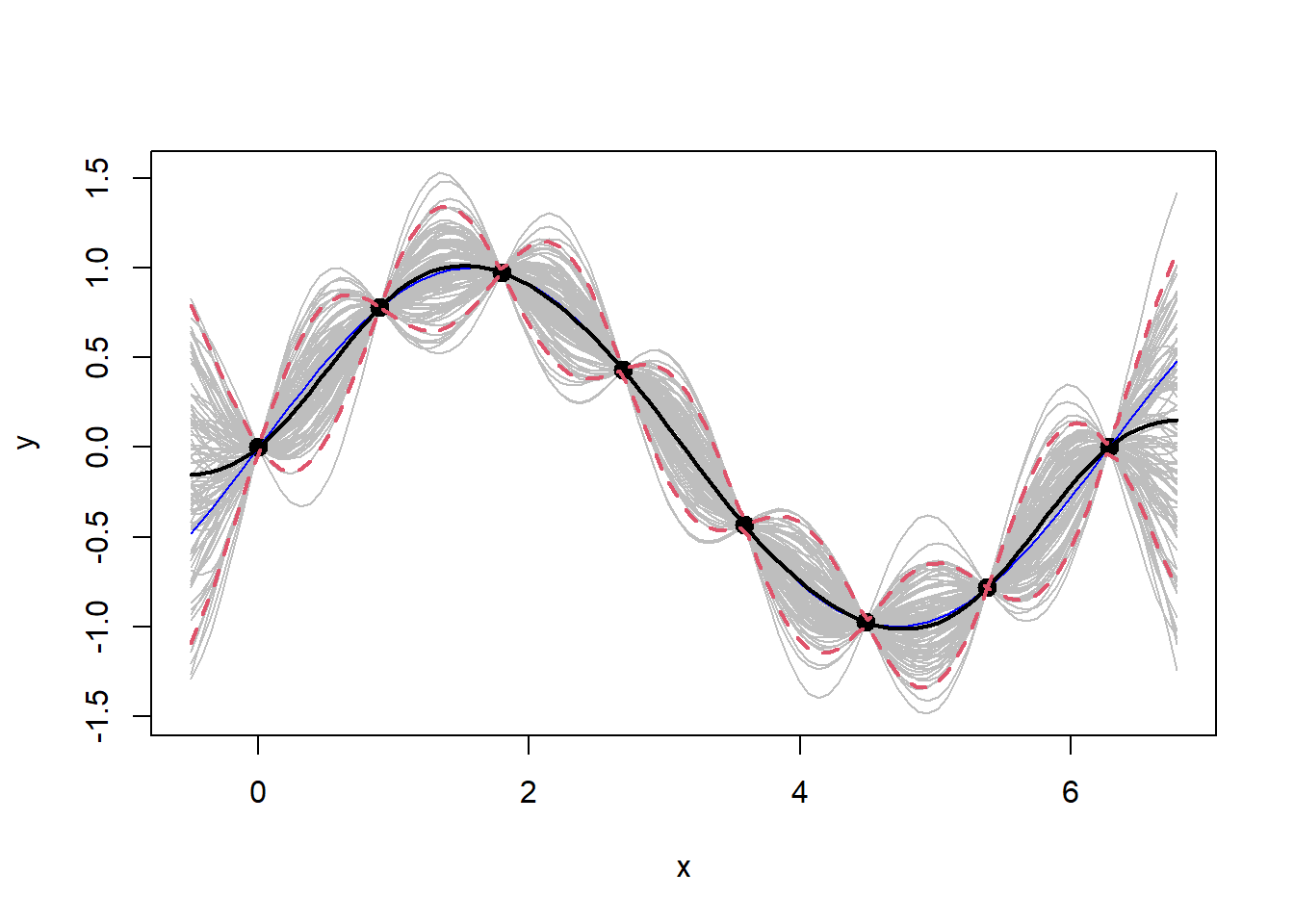

Generate Y values from the posterior/predictive distribution and plot.

YY <- rmvnorm(100, mup, Sigmap)

# Error bars

q1 <- mup + qnorm(0.05, 0, sqrt(diag(Sigmap)))

q2 <- mup + qnorm(0.95, 0, sqrt(diag(Sigmap)))

# Plot

matplot(XX, t(YY), type="l", col="gray", lty=1, xlab="x", ylab="y")

points(X, y, pch=20, cex=2)

lines(XX, sin(XX), col="blue")

lines(XX, mup, lwd=2)

lines(XX, q1, lwd=2, lty=2, col=2)

lines(XX, q2, lwd=2, lty=2, col=2)

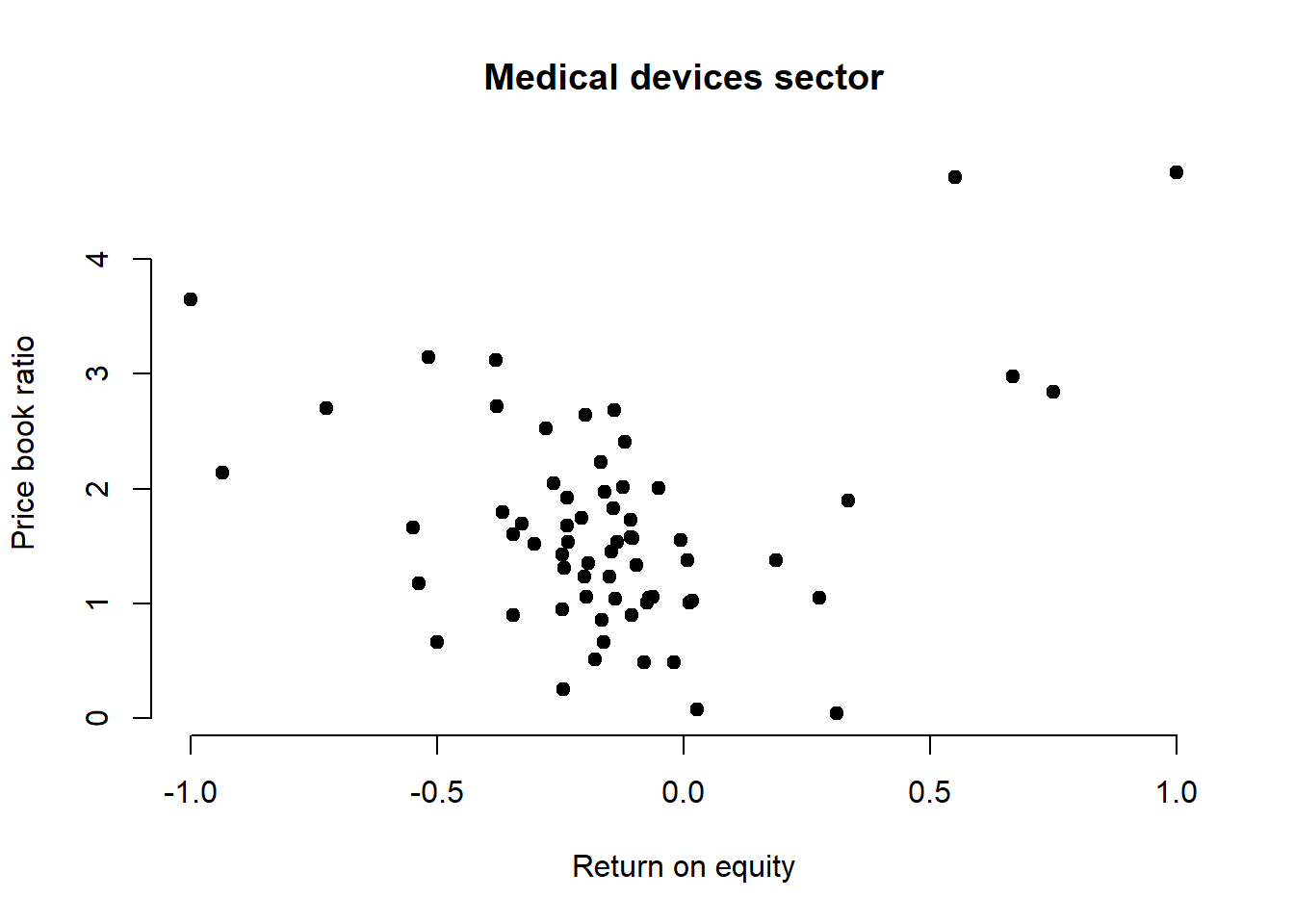

Stock data example

The procedures above are now applied to real data, that being stock valuations and fundamentals.

Data

library(romerb)

data("stock_data")

fundamental_raw <- stock_data

rm(stock_data)

# Medical devices sector only

df <- fundamental_raw[fundamental_raw$sector == 7, ]

df$log_mkt_cap <- log(df$mkt_cap)

df$log_book <- log(-df$total_equity_cln)

df <- df[df$date_stamp == as.Date('2021-06-30'), c('log_book','log_mkt_cap','log_pb','roe','leverage')]

# nugget / jitter

eps <- sqrt(.Machine$double.eps)

# Training data

X <- matrix(df$roe)

y <- matrix(df$log_pb)

# Predictive grid

XX <- matrix(seq(min(X), max(X), length=200), ncol=1)

# Plot

plot(X, y, main = "Medical devices sector",

xlab = "Return on equity", ylab = "Price book ratio",

pch = 19, frame = FALSE)

Covariance function / MVN conditioning

D <- plgp::distance(X)

Sigma <- exp(-D) + diag(eps, length(X))

DXX <- plgp::distance(XX)

SXX <- exp(-DXX) + diag(eps, length(XX))

SX <- exp(-distance(XX, sort(X))) # note the sort, required to construct symmetric matrix at Sigmap

# Kriging equations, mean mup and variance Sigmap

Si <- solve(Sigma)

mup <- SX %*% Si %*% y

Sigmap <- SXX - SX %*% Si %*% t(SX)

Sigmap <- sfsmisc::posdefify(Sigmap, method = "allEVadd")

# Generate Y values & error bars from the posterior/predictive distribution

YY <- rmvnorm(100, mup, Sigmap)

q1 <- mup + qnorm(0.05, 0, sqrt(diag(Sigmap)))

q2 <- mup + qnorm(0.95, 0, sqrt(diag(Sigmap)))