Gaussian Process regression - R

laGP

A replication of the Gaussian Process regression implementation from chapter 5 of Surrogates. Application of the same code to real data.

Chapter example

Data

Create some dummy data being an independent and dependent variable, along with a grid of the independent variable values.

# Training data

n <- 8

X <- matrix(seq(0, 2*pi, length=n), ncol=1) # independent variable

y <- sin(X)

# Predictive grid

XX <- matrix(seq(-0.5, 2*pi + 0.5, length=100), ncol=1)

# Nugget / jitter

eps <- sqrt(.Machine$double.eps) Using function newGP

Note the parameters:

d: a positive scalar lengthscale parameter for an isotropic Gaussian correlation function (newGP); or a vector for a separable version (newGPsep), and

g: a positive scalar nugget / jitter parameter

are seeded with the darg``` andgarg``` functions.

## Warning: package 'laGP' was built under R version 4.1.3##

## Attaching package: 'laGP'## The following object is masked from 'package:plgp':

##

## distance# Derive sensible parameter ranges

d <- darg(NULL, X)

y[1] <- 1e-3 # negate garg error: Error in check.arg(g) : d$min should be a postive scalar < d$max

g <- garg(NULL, y)

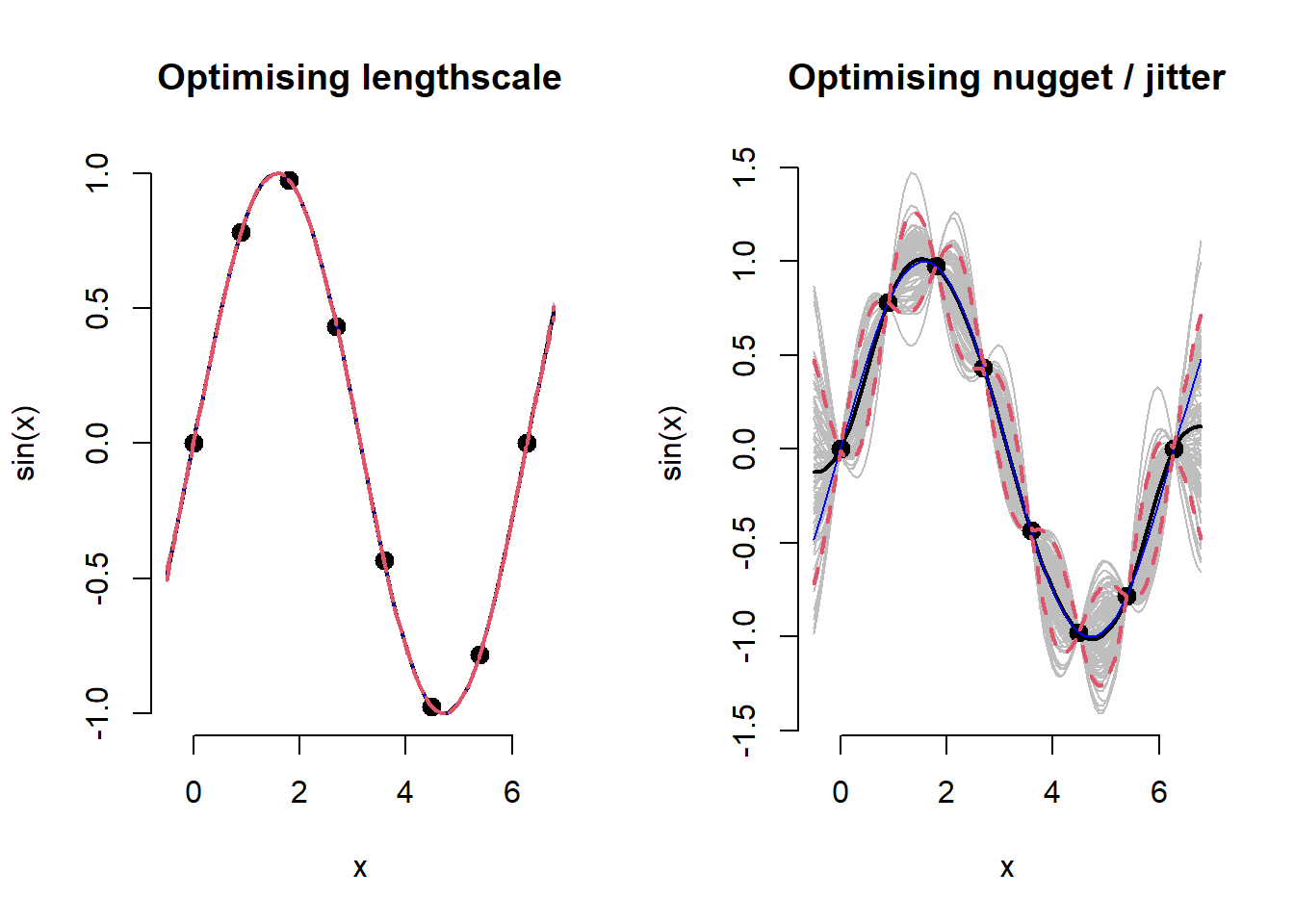

par(mfrow=c(1,2))

for(parm in c('d','g')) {

# GP

gpi <- newGP(X, y, d=d$start, g=g$start*0.5, dK=TRUE)

#mle <- mleGP(gpi)

mle <- mleGP(gpi, param=parm, tmin=ifelse(parm == 'd', d$min, g$min), tmax=ifelse(parm == 'd', d$max, g$max))

p <- predGP(gpi, XX)

YY <- mvtnorm::rmvnorm(100, p$mean, p$Sigma)

q1 <- p$mean + qnorm(0.05, 0, sqrt(diag(p$Sigma)))

q2 <- p$mean + qnorm(0.95, 0, sqrt(diag(p$Sigma)))

# Plot

matplot(XX, t(YY), type="l", col="gray", lty=1,

main = paste0("Optimising ", ifelse(parm == 'd', 'lengthscale', 'nugget / jitter')),

xlab="x", ylab="sin(x)", bty = "n")

points(X, y, pch=20, cex=2)

lines(XX, p$mean, lwd=2)

lines(XX, sin(XX), col="blue")

lines(XX, q1, lwd=2, lty=2, col=2)

lines(XX, q2, lwd=2, lty=2, col=2)

deleteGP(gpi)

rm(mle)

}

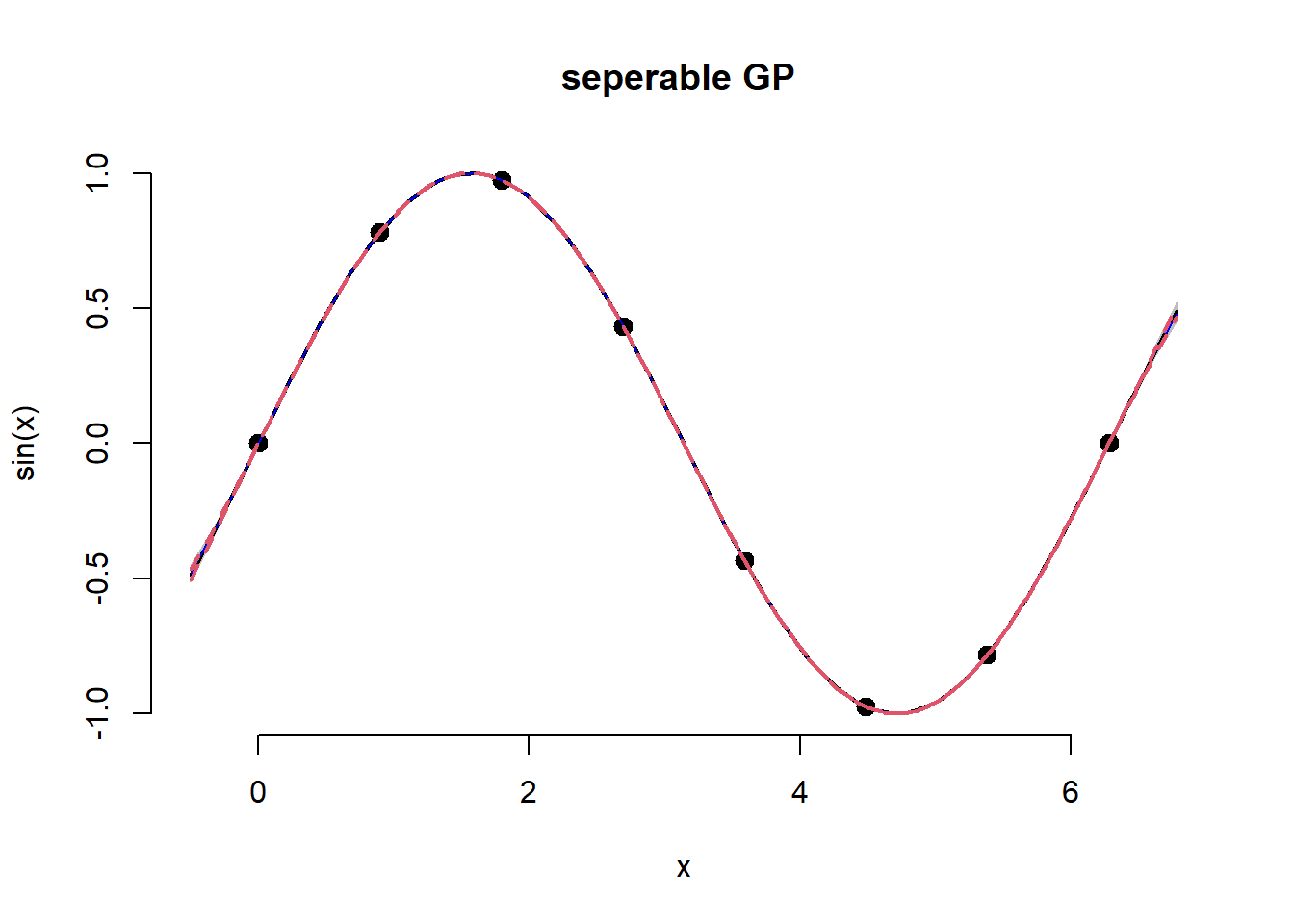

Using function newGPsep

A separable GP, the lengthscale parameter is allowed to decay at differing rates dependent on the input data. This is an anisotropic, rather than isotropic model.

gpi <- newGPsep(X, y, d=d$start, g=g$start*0.5, dK=TRUE)

mle <- mleGPsep(gpi, param='both', tmin=c(d$min, g$min), tmax=c(d$max, g$max))

p <- predGPsep(gpi, XX)

YY <- mvtnorm::rmvnorm(100, p$mean, p$Sigma)

q1 <- p$mean + qnorm(0.05, 0, sqrt(diag(p$Sigma)))

q2 <- p$mean + qnorm(0.95, 0, sqrt(diag(p$Sigma)))

# Plot

matplot(XX, t(YY), type="l", col="gray", lty=1,

main = "seperable GP ",

xlab="x", ylab="sin(x)", bty = "n")

points(X, y, pch=20, cex=2)

lines(XX, p$mean, lwd=2)

lines(XX, sin(XX), col="blue")

lines(XX, q1, lwd=2, lty=2, col=2)

lines(XX, q2, lwd=2, lty=2, col=2)

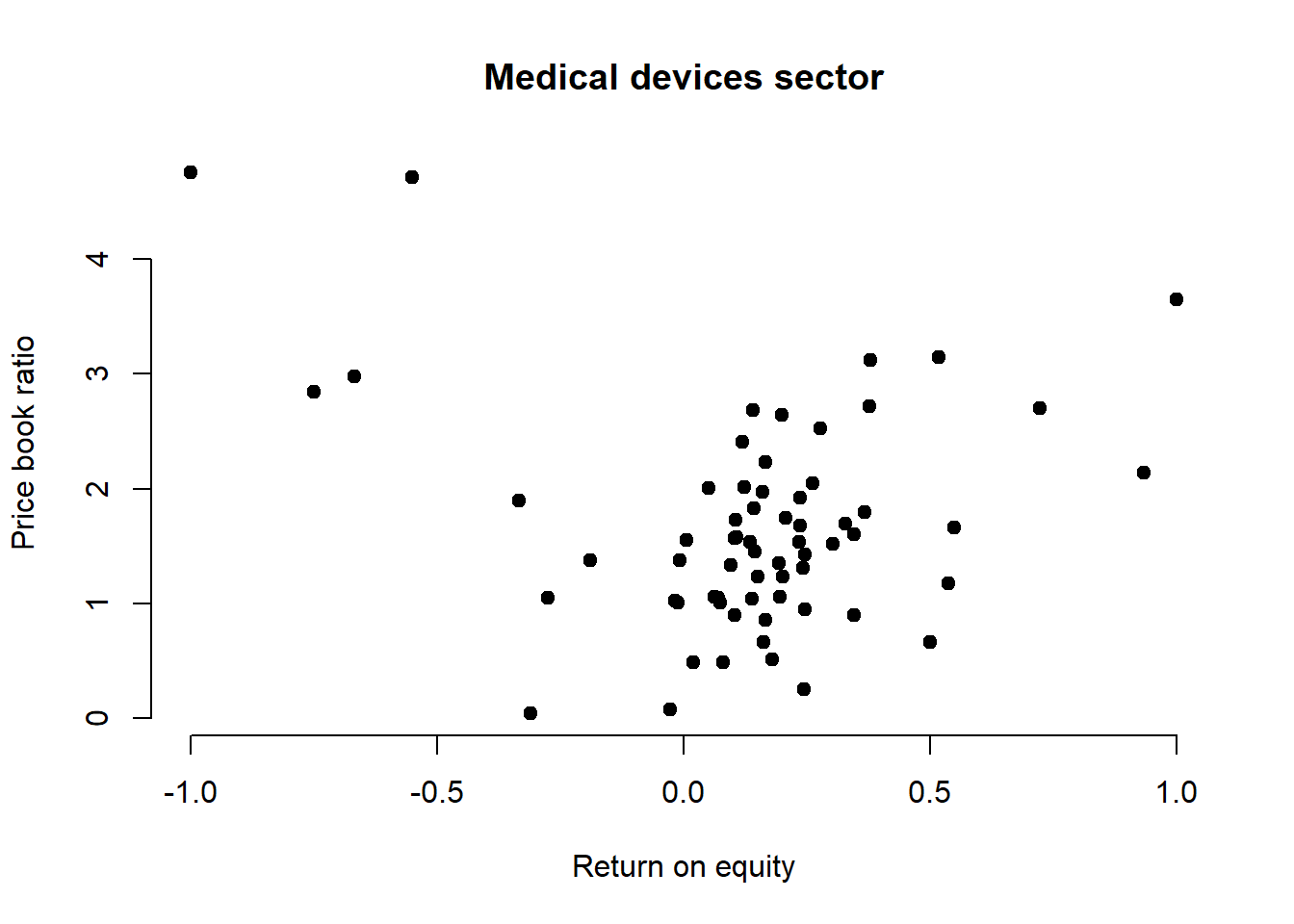

Stock data example

The procedures above are now applied to real data, that being an estimation of stock valuation based on fundamental data.

Data

library(romerb)

data("stock_data")

fundamental_raw <- stock_data

rm(stock_data)

# Medical devices sector only

df <- fundamental_raw[fundamental_raw$sector == 7, ]

df$log_mkt_cap <- log(df$mkt_cap)

df$log_book <- log(-df$total_equity_cln)

df$roe <- -df$roe

df <- df[df$date_stamp == as.Date('2021-06-30'), c('log_book','log_mkt_cap','log_pb','roe','leverage')]

# nugget / jitter

eps <- sqrt(.Machine$double.eps)

# Training data

X <- matrix(df$roe)

y <- matrix(df$log_pb)

# Predictive grid

XX <- matrix(seq(min(X), max(X), length=200), ncol=1)

# Plot

plot(X, y, main = "Medical devices sector",

xlab = "Return on equity", ylab = "Price book ratio",

pch = 19, frame = FALSE)

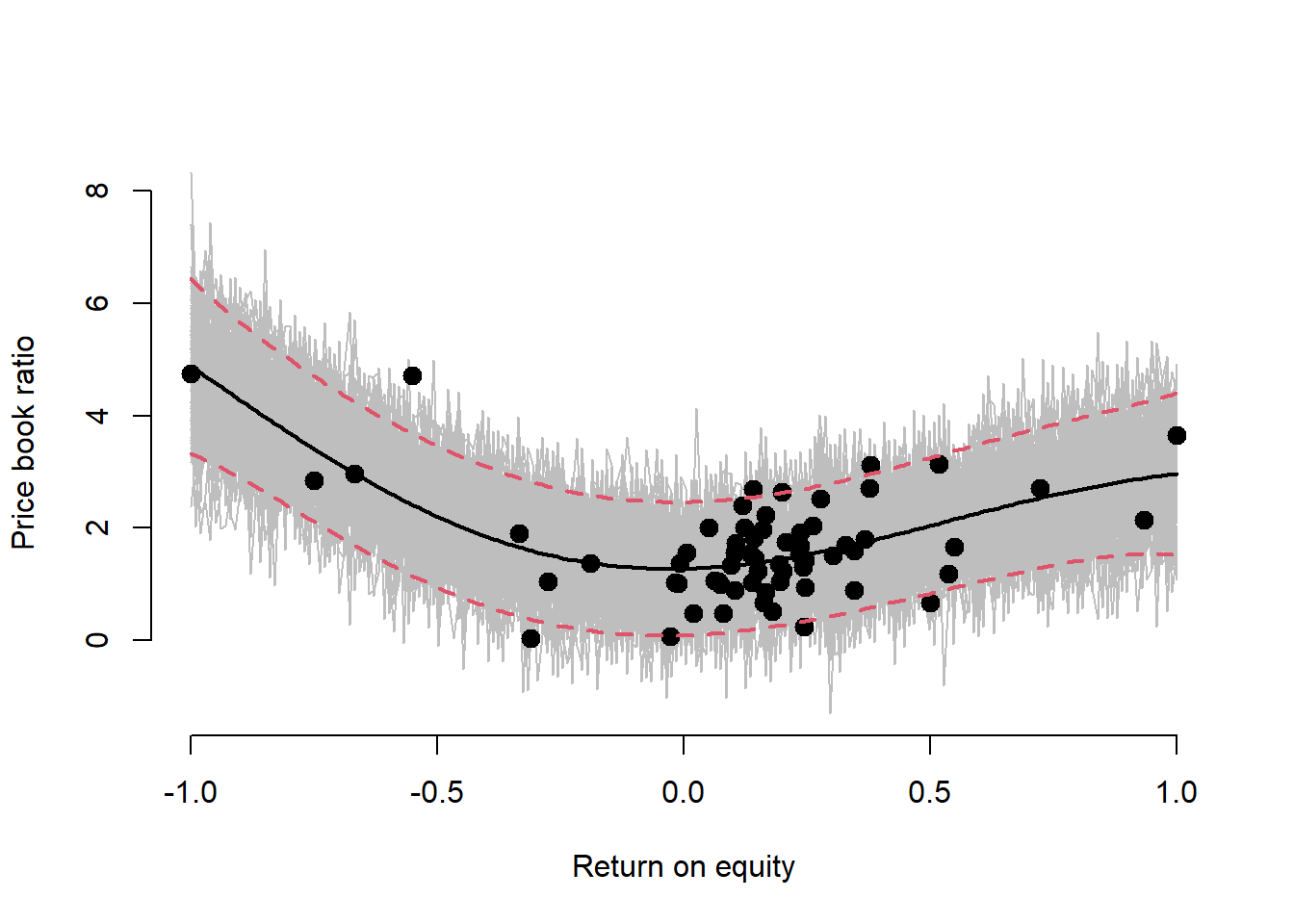

d <- darg(NULL, X)

g <- garg(NULL, y)

gpi <- newGPsep(X, y, d=d$start, g=g$start*0.5, dK=TRUE)

mle <- mleGPsep(gpi, param='both', tmin=c(d$min, g$min), tmax=c(d$max, g$max))

p <- predGPsep(gpi, XX)

YY <- mvtnorm::rmvnorm(100, p$mean, p$Sigma)

q1 <- p$mean + qnorm(0.05, 0, sqrt(diag(p$Sigma)))

q2 <- p$mean + qnorm(0.95, 0, sqrt(diag(p$Sigma)))

# Plot

matplot(XX, t(YY), type="l", col="gray", lty=1,

xlab = "Return on equity", ylab = "Price book ratio", bty = "n")

points(X, y, pch=20, cex=2)

lines(XX, p$mean, lwd=2)

lines(XX, q1, lwd=2, lty=2, col=2)

lines(XX, q2, lwd=2, lty=2, col=2)

References

Functions creating dummy data. Useful for model testing.

tpg vignette, refer page 3 for dummy data function

Gold

price function from the GPfit doucmentation.

Other Gaussian Process packages